Making the Business Case for Sustainability

May 23, 2024

Sustainability has emerged as a key driver of competitive advantage and long-term profitability, but not everyone has grasped the revenue-generating potential yet. The challenge lies in effectively communicating the business advantages to decision-makers who see only the environmental aspect. How can champions bridge this gap, transforming environmental responsibility from a concept into a powerful business asset?

This article will focus on the business advantages of a robust sustainability plan and provide advocates with the strategic insights necessary to communicate these benefits to stakeholders and secure their support. The era of treating sustainability as an optional exercise is over. It must be positioned as a strategic imperative, guiding your organization toward lasting success and stakeholder satisfaction.

The Business Advantages of Embracing Sustainability

What exactly makes sustainability appealing to stakeholders? Below, we've detailed the key benefits of a thorough approach. You can use these insights to develop, refine and communicate your strategy to stakeholders.

Increased Operational Efficiency

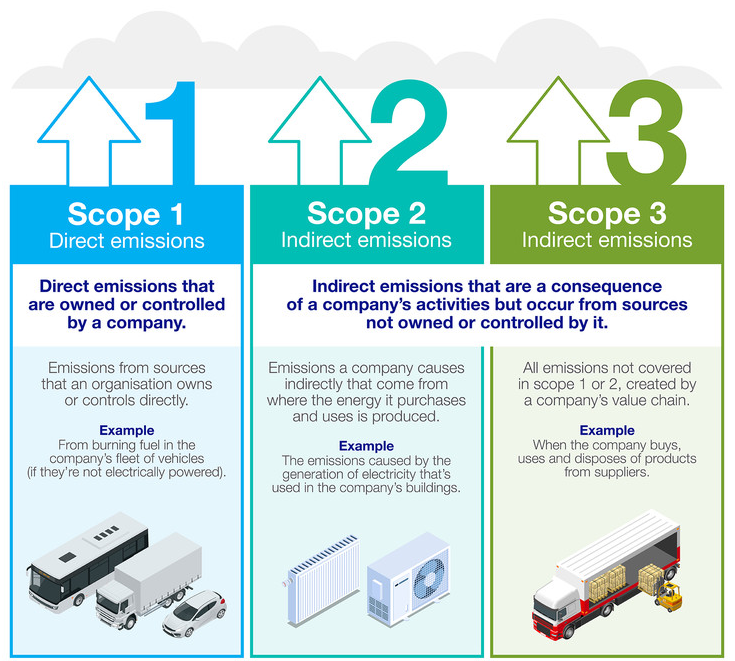

To effectively communicate the wide-ranging benefits of sustainability, it is essential to highlight how addressing Scope 1, 2 and 3 emissions leads to substantial operational improvements, business longevity and profitability.

Scope 1 Emissions:

- Direct greenhouse gas emissions from owned or controlled sources.

- Minimized by adopting cleaner technologies like electric vehicle supply equipment (EVSE) and by optimizing processes that reduce fuel combustion.

- Results in lower operational costs and enhanced resource management.

Scope 2 Emissions:

- Indirect emissions from the generation of purchased energy.

- Reduced by integrating LED lighting, smart building controls and by transitioning to renewable energy sources like solar, wind, or hydropower.

- Benefits include lower utility expenses and incentives from governments and utilities.

Scope 3 Emissions:

- Encompasses all other indirect emissions in the value chain, including upstream and downstream activities.

- Opportunity for companies to engage with suppliers and partners for collective emissions reductions. This includes ensuring sustainable procurement practices, optimizing logistics and transportation, and refining product lifecycle management.

- Improves supply chain sustainability, reduces waste, fosters efficiency and innovation, cuts costs and ensures ethical material sourcing.

Source: National Grid

Improving Scope 1, 2 and 3 emissions creates a host of new avenues for operational advantages, some not as immediately apparent compared to others. For example, companies that leverage an emissions reduction plan can generate savings in maintenance and operational costs and increase their property value.

One study of LEED-certified buildings estimated that they generated as much as $1.2 billion in energy savings, $149.5 million in water savings, $715.3 million in maintenance savings, and $54.2 million in waste savings between 2015 and 2018. The operational efficiencies achieved lead to direct cost savings, an improved corporate image, and a more robust, resilient business model.

Mitigated Risks and Expenses

With environmental regulations becoming stricter globally, preemptive adoption of sustainability measures ensures compliance and avoids costly penalties, regardless of the market. The repercussions of non-compliance with regulations are both environmental and financial, impacting businesses across all sectors. For example:

- Regulatory Fines: Companies can face significant fines for failing to comply with waste management, emissions and energy usage regulations. Proactive measures such as recycling programs, efficient energy management systems and smarter technologies can mitigate these risks.

- Operational Disruptions: Non-compliance may lead to operational shutdowns imposed by regulatory bodies, resulting in lost productivity and revenue. Investing in sustainable practices ensures continuous operation and business resilience.

- Reputational Damage: Companies found to be non-compliant with environmental regulations risk severe damage to their reputation, which can erode customer trust and loyalty. Transparent sustainability practices enhance brand image and

- Increased Scrutiny: Businesses that fail to comply with regulations are more likely to attract scrutiny from investors, stakeholders and regulatory bodies. Implementing robust reporting and data management systems ensures transparency and builds stakeholder confidence.

- Financial Liabilities: Beyond fines, non-compliance can lead to increased liabilities related to environmental cleanup and remediation efforts. Preventative measures and risk mitigation strategies reduce potential liabilities and associated costs.

By adopting sustainability measures early, you can avoid costly penalties, maintain operational continuity and enhance your competitive advantage.

Shielding Against Price Volatility

Sustainability-focused strategies lead to a more efficient use of resources, resulting in direct cost savings. More importantly, they insulate companies from the volatility of commodity prices and the increasing costs associated with carbon emissions.

According to the United Nations, renewable energy is the cheapest power option in most parts of the world today, and prices are dropping rapidly. The cost of electricity from solar power fell by 85 percent between 2010 and 2020, and the costs of onshore and offshore wind energy fell by 56 percent and 48 percent, respectively. Investing in renewable energy sources and energy-efficient technologies shields businesses from fluctuating energy prices, offering a more predictable expense forecast.

Avoiding the Burden of Ageing Infrastructure

Investing in sustainable practices often requires adopting innovative technologies and systems that contribute to a modern, efficient infrastructure. Whether it's through implementing smart building technologies, renewable energy solutions, or efficient waste management systems, these investments pave the way for operational optimizations that are financially beneficial.

Modern infrastructure, built on the principles of sustainability, ensures that businesses are not only prepared for the future but are actively shaping it. With advanced automation, businesses can adjust energy systems based on peak energy hours, occupancy and weather events. These systems detect faults early, automate dispach work orders and drive down maintenance costs instead of applying a band-aid approach to maintain aging facilities.

Enhancing Investor Appeal and Market Share

Adopting a comprehensive sustainability strategy significantly bolsters a company's appeal to investors and, subsequently, its market share. Today's investors increasingly prioritize environmental, social and governance (ESG) criteria in their investment decisions.

A 2024 survey from Morgan Stanley illustrates this, citing that 77% of global individual investors say they are interested in investing in companies or funds that aim to achieve market-rate financial returns while considering positive social and environmental impact. 54% anticipate boosting allocations to sustainable investments within the next year. Investors recognize that companies with proactive ESG practices are better poised for long-term success, making them more attractive investment opportunities.

Fostering Employee Satisfaction, Reducing Turnover and Attracting Talent

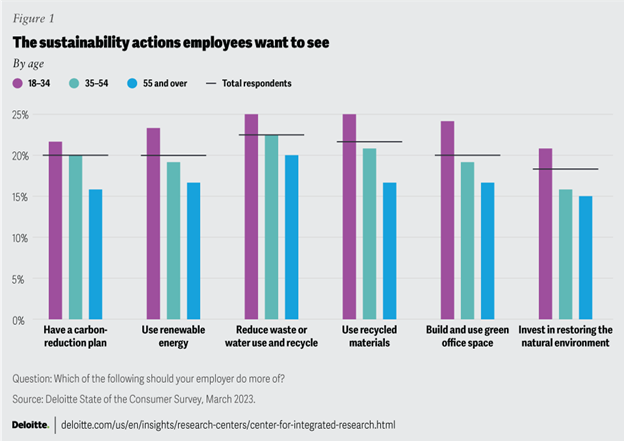

A survey reported by Deloitte highlighted that 69% of employed adults want their companies to invest in ESG efforts, including reducing carbon, using renewable energy and reducing waste. This shows that ESG initiatives benefit the environment and increase employee satisfaction.

Embracing sustainability may reduce turnover rates too. Research from MIT Sloan highlights that 26% of employees would consider switching jobs for a more sustainable organization. This alignment of values strengthens loyalty and retention while attracting top talent, particularly from younger generations who prioritize environmental responsibility.

Additionally, prospective employees are increasingly looking for employers whose values resonate with their own, and environmental responsibility is no exception. Consequently, companies at the forefront of sustainability become more attractive employers, capable of drawing in and keeping a passionate, innovative workforce.

Strengthening Customer Loyalty

Sustainability initiatives convey a message of responsibility and foresight, attributes that resonate deeply with today's consumers, and they are responding with their wallets. According to a 2023 McKinsey & Company survey, products that make environmental, social and governance-related claims have a 1.7% boost in their compound annual growth rate (CAGR) compared to products that don't make ESG-related claims.

Moreover, when companies consistently commit to sustainable practices, they cultivate customer trust and loyalty. This loyalty is emotional and behavioral, with customers more likely to repeat purchases and advocate for the brand within their networks. This loyalty is invaluable, as retained customers contribute more significantly to revenues than newly acquired ones.

Driving the Bottom Line

Sustainability is a powerful business asset that drives competitive advantage and long-term profitability. An integrated approach offers numerous benefits, including reduced energy costs, operational efficiencies, increased investor appeal, higher employee satisfaction and enhanced customer loyalty.

Positioning environmental responsibility as a strategic necessity can guide organizations toward continued success and stakeholder satisfaction. Sustainability is not just about ecological responsibility—it’s a strategic move for long-term success.

Energy Management Collaborative (EMC) manages and scales turnkey energy efficiency solutions for Fortune 500 clients across their North American portfolios. Since 2003, the company has used its total project management approach, EnergyMAXX®, to successfully implement thousands of projects annually including efficient lighting, smart building controls, specialty disinfectant lighting, ROI-driven IoT solutions, electric vehicle supply equipment infrastructure and ongoing maintenance and warranty support. In doing so, EMC has helped clients realize billions of kilowatt-hours of energy savings and advance their net zero emissions goals.