What's your strategy to mitigate rising electric rates?

October 4, 2023

With commercial electric prices in the U.S. rising nearly 20% since 2020, and an anticipated annual increase of 5-7%, building owners have invested in advanced building control systems for proactive adjustments to evolving utility pricing. EMC has helped numerous building portfolio owners assess energy efficiency and building control retrofit options and set site priorities, reducing both costs and risks. The solutions we offer include an anticipated return on investment that only improves as rates go up.

But what’s behind these rate increases? While no forecast can predict all the variables, breaking down the likely key factors allows consideration of how and if expected returns on investment should be adjusted.

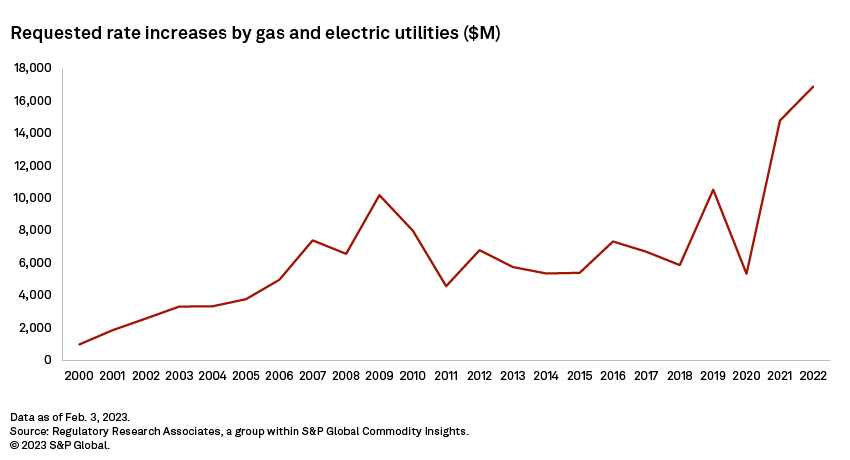

Record Setting Rate Increases

U.S. investor-owned utilities requested rate increases totaling a combined $16.9 billion in 2022, up about 14% from a record-setting 2021.

With more than $3 billion in rate increase requests filed through early 2023, it is likely to be another banner year for rate case activity.

Key Cost Drivers

The electric rate filings in part reflect significant capital expenditure plans for upgrading transmission and distribution systems as well as installing new renewable energy generation and innovative technologies to support broader clean energy initiatives. A deeper look at three other factors is necessary to consider trends that affect investment decisions:

Inflation. The electric utility industry has not been immune from the recent cost increases associated with labor shortages and supply chain issues. These general market inflation impacts can be expected to continue to affect electric rates. The 2-3% annual increases we’ve experienced for the past 30+ years is a reasonable conservative projection.

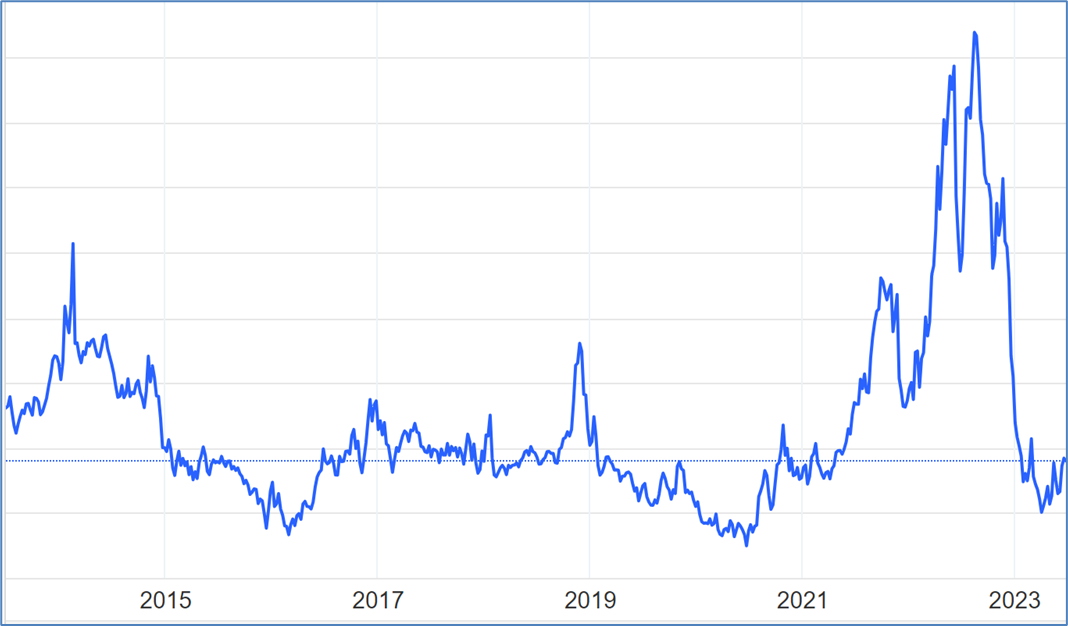

Natural Gas Prices. About 40% of U.S. electric generation in 2022 was fueled by natural gas. The war in Ukraine was the primary driver of a huge spike in global gas prices. The market has since identified alternatives that have brought those prices back to pre-war levels.

While reliance on volatile sources is clearly an ongoing risk element, our forecast does not presume this to be a predictable driver of future natural gas price increases, beyond the degree it is a component of the long-term observed inflation pace noted above.

Decarbonization via Electrification. To varying degrees, states within the U.S. are committing to reducing carbon emissions. This follows (and in some cases leads) federal and even global initiatives. A primary strategy is to replace fossil fuel with electric alternatives for electric vehicles, heating, cooking and industrial processes.

The leap of faith behind these policies is that the electric grid will both decarbonize and build capacity to serve a significant increase in total demand.

Decarbonization involves converting electric generation plants from coal and natural gas to solar, wind, nuclear, fuel cell and other carbon-free options, supported in many cases by battery storage.

Funding Strategies

Broad-scale electrification of the economy will require major generation and grid investments.

In the U.S., federal legislation is in place that is expected to support investment by utilities and private generation developers. The degree of support is difficult to predict, but like any policy is subject to change as political control cycles.

No federal program scenario will cover 100% of the costs, and it is expected that ratepayers will likely bear a significant share of the investment. Utilities are beginning to cite these costs in their rate increase filings, and responses from regulators have been telling.

Residential customer advocates have been effective in using equity-based arguments to reduce increases. This leaves the bulk of the impact to be felt by commercial and industrial (C&I) facility owners.

Components of Recent Increases

Recent increase rates vary, with some regional generalization possible. If we look at the U.S. average of 9% per year over the past two years, we can piece together the three primary drivers mentioned above and assemble a summarized forecast by component:

-

“Regular” inflation: 2-3%

-

Electrification/decarbonization grid upgrade costs: 2-4%

-

Natural gas prices: 2-3%

As noted earlier, the natural gas price effect was closely tied to a specific event, and the market has developed a resolution. Inflation is likely to continue to follow the long-term trend, and commitments to electrification seem to be embedded at several levels.

All these factors combined suggest a reasonable expectation that average electric prices for commercial and industrial companies could increase at an average annual rate of 5-7% for the next several years. This will vary by region—rates are expected to be higher in places like New England and the West Coast.

Proactive Responses

An investment in energy efficiency is equivalent to buying a small power plant, where rate increases further the value of the investment. Utilities look at it this way too, with their investments reflected as rebate offers.

Those proactive building owners investing in enhanced building control systems will have greater ability to respond to variable utility pricing.

Smart building control capabilities like scheduling and metering allow them to respond to new industry trends like time-of-use pricing, which more utilities are developing. It allows them to match prices more closely with actual costs and even reduce the total cost of service.

EMC helps building portfolio owners assess energy efficiency and building control retrofit options and set site priorities, reducing both costs and risks. Contact EMC for more information about how we can help you with your plan to deal with these changing times.

Kris Leaf is EMC's Senior Manager of Customer Incentives. He has developed and managed energy efficiency incentive programs for numerous utilities including Xcel Energy, ComEd and MidAmerican Energy. Kris has a degree in Mechanical Engineering from the University of Minnesota and is pursuing a master’s degree in Sustainable Business from the University of Wisconsin-Madison.